The central idea of Modern Monetary Theory (MMT), as I understand it, is that, rather than worrying about budget balances, governments and monetary authority should set taxation levels, for a given level of public expenditure, so that the amount of money issued is consistent with low and stable inflation. In this context, the value of the net increase in money issue is referred to as seigniorage. To the extent that seigniorage is consistent with stable inflation, it is achieved by mobilising previously unemployed resources.

A crucial question is: what is the scope for seigniorage? In particular (expressing things in MMT terms), is the scope for seigniorage sufficient to permit the introduction of ambitious programs like a Green New Deal without the need for higher taxes to prevent inflation.

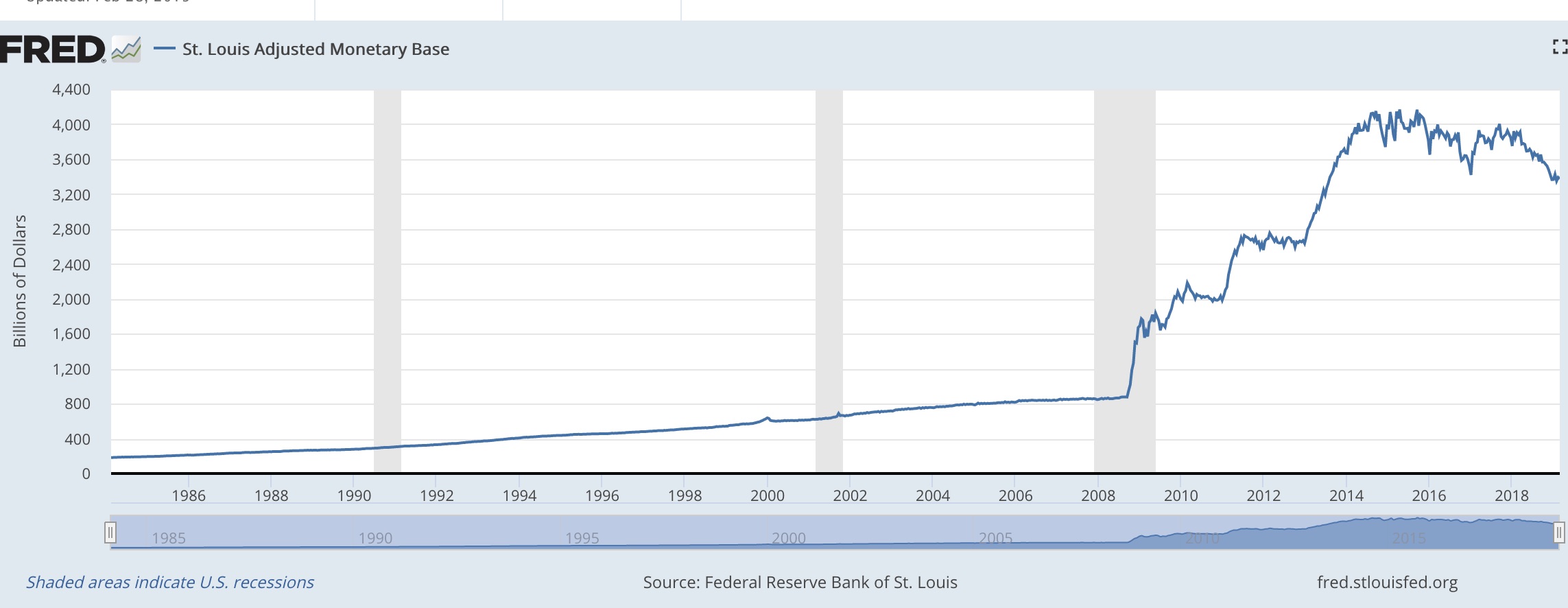

The recent episode of Quantitative Expansion in the US provides some evidence here. Contrary to the dire predictions of some critics, QE did not lead to runaway inflation. This is consistent with the view, shared by MMT advocates and mainstream Keynesians, that, in the context of a liquidity trap and zero interest rates, there is substantial scope for monetary expansion.

How much is “substantial”?

According to the St Louis Fed,

the monetary base grew from around $800 billion to just over $4

trillion between 2008 and 2016. That’s an increase of $3.2 trillion,

which is a lot of money. Expressed in terms of GDP, though, it doesn’t

seem quite as large. Over eight years, $3.2 trillion is $400 billion a

year or around 2 per cent of US GDP ($20 trillion).

Assuming that this is an upper bound for the scope of seigniorage, it’s much smaller than the amount needed to finance, say, a Green New Deal.

What qualifications need to be made here? First, it might be argued that QE should have been more aggressive than it was. Certainly, looking at things with a focus on the real economy, as traditional Keynesians do, the stance of fiscal and monetary policy overall was too restrictive. But, if you assess things on the MMT criterion of low and stable inflation, the Fed got it pretty much right. Deflation was avoided, and the inflation rate was restored to the target level of 2 per cent in a reasonably short time. That’s continued as QE has been partially reversed in recent years.

A second point is that QE wasn’t (directly) an expansionary fiscal policy of the kind Keynesians favour. Rather, the budget deficit (smaller than it should have beeb) was financed with bonds. The sale of these bonds to the public would have depressed demand, but instead the Fed bought them (and also some high-grade corporate bonds). That’s not the best way to stimulate the economy, but from an MMT viewpoint it’s not obvious that it matters (interested to get comments on this).

Overall, the evidence of QE suggests to me that the basic idea of MMT is sound, at least in the context of a llquidity trap. On the other hand, the same episode shows that a widespread interpretation of MMT, that we can greatly expand public expenditure with no corresponding increase in taxation, is both wrong and inconsistent with the core idea of MMT.

I think the MMT ideas are simply warmed up Keynesian ones, and there is a lot of doubt if they are correct. Of course a government has control of the money situation and in fact (as described in my book) there are actually 7 or 8 different ways it can do this. Not all of them are very effective, but my point is that the MMTites should be more broard-minded and not continue to repeat the old tired Keynesian claims.

After an early immoderate enthusiasm for MMT, some aspects of it have come to trouble me.

1. Is it a descriptive theory or a prescriptive theory? Or both?

The opening and strong claim made by its major theorists is that it is simply a descriptive theory. It describes how modern monetary systems actually work. However, it’s not long, in any piece of advocacy, before MMT gets applied and used as a prescriptive theory for managing the real economy. I have no problem with this as such. The basic conclusions of descriptive MMT I accept. The left biases of the prescriptive portion are biases with which I agree in the main (though they don’t go far enough).

Perhaps the key MMT advocates need to be clearer on just what MMT is. For example; “This first part is MEMT – Modern Extant Monetary System(s). This second part, Applied MEMT, illustrates how this system can be used more flexibly and extensively than currently under monetarism. The principles underpinning suggestions for Applied MEMT are drawn from various orthodox and heterodox sources.” This sort of description would be more clear and honest in my opinion.

The Job Guarantee under MMT may be truly original in its proposal to substitute a buffer stock of employment for a buffer stock of the unemployed. I am not knowledgeable enough about that part of economics to judge it. If JG theory (and practice advocacy) is original then applied MMT is not simply drawn eclectically from orthodox and heterodox “leftish” sources.

2. MMT still appears too attached, theoretically and practically, to growth economics: growth as the solution to unemployment, and paid employment as the solution for economic income and social meaning. In other words, it firstly does not pay adequate attention to the oncoming limits to growth and sustainability crisis. It also does not radically challenge capitalist categories such as capitalist and worker, rooted as they are in the construction of ownership by property rights theory.

In the end, MMT is another “reform capitalism” theory and all who read this blog should know by now how much such theories underwhelm me these days.

I have no independent information on MMT. My comments relate to the content of JQ’s post.

1. “The central idea of Modern Monetary Theory (MMT), as I understand it, is that, rather than worrying about budget balances, governments and monetary authority should set taxation levels, for a given level of public expenditure, so that the amount of money issued is consistent with low and stable inflation. In this context, the value of the net increase in money issue is referred to as seigniorage.”

The first sentence seems two me to be a version of the monetarist policy model from the 1970s if not earlier, except that a government sector is specified in a rudimentary way. What is the supply of ‘money’ (“the amount”) ? What is ‘money’? How can you solve for the taxation levels required, given a level of public expenditure, without using the notion of a budget constraint (ie an identity)?

The term “seigniorage” refers to the difference between the face value of ‘money’, such as a $10 bill, and the cost to produce it. In other words, the economic cost of producing a currency within a given economy or country. (Source: Investopedia, among others). I recall during the early 1980s (ie before the ‘big bang’), seigniorage was associated with ‘profit’ made by central monetary authorities when issuing ‘money’. It was used by some Finance people to argue for liberalising the financial system because seigniorage is a cost to ‘the economy’. (JQ, I wonder how you would treat seigniorage in your opportunity cost framework.)

Seigniorage is a meaningful notion if a monetary authority issues commodity money that involves production costs. With electronic ‘money’ transfers, the economic cost of transferring $1 is the same as $1 trillion.

In short, I cannot extract a coherent idea from the description of the central idea of MMT.

2. “The recent episode of Quantitative Expansion in the US provides some evidence here. Contrary to the dire predictions of some critics, QE did not lead to runaway inflation. This is consistent with the view, shared by MMT advocates and mainstream Keynesians, that, in the context of a liquidity trap and zero interest rates, there is substantial scope for monetary expansion.”

I don’t know about ‘Quantitative Expansion’. I assume it is the same as Quantitative Easing (QE).

IMO, QE had nothing to do with mainstream Keynesian (or MMT whatever it is) monetary policy. Its aim was to prevent the collapse of the financial system, including the payment system. I do not know why QE should lead to a runaway inflation or any inflation, given that QE involved buying up so-called financial assets (not only treasury bonds and high quality private bonds but also mortgage backed securities). At least a non-trivial “amount” of these financial assets correspond to ‘money’ that was created by the private financial sector. This ‘money’ had already been spent – unwisely to a large extent (eg mortgage backed securities).

https://www.investopedia.com/ask/answers/041415/when-federal-reserve-bank-engaged-quantitative-easing-did-it-add-m1.asp

Without a precise theoretical model (ie a mathematical model), one can only guess as to what is meant by the words. What does seigniorage mean in the context of QE? Does it mean amounts of currency units issued, if so by whom, or does it mean the net profit which central banks have made by not letting the financial system collapse?

I’d be most grateful if I could get a reference to a precise model of MMT (say no more than 50 pages).

The foregoing is my comment to JQ’s specific question: “The sale of these bonds to the public would have depressed demand, but instead the Fed bought them (and also some high-grade corporate bonds). That’s not the best way to stimulate the economy, but from an MMT viewpoint it’s not obvious that it matters (interested to get comments on this).

Ikonoclast,

Glad to bump in to you here. I have enjoyed your comments on Bill Mitchell’s website. I see by your comment that you are a regular here. That is a pretty good recommendation for this site. I got here by following links from Cold Dark Stars to Crooked Timber to here. I guess I will now look around a bit more on this blog.

Here is a link to an Australian MMT site. Any reader can use this site to gain a greater understanding of the subject.

http://bilbo.economicoutlook.net/blog/?p=41727#more-41727

Ernestine makes some very valid points. Like her I learnt all my monetary policy theory in the 1970s. This was when Milton Friedman was at the height of his theoretical ascendency. My Professor of Economics was John Neville. He had advanced the Super Multiplier Theory as a way to gauge the impact of government spending on economic growth. Up until the late 1970s inflation had not being a problem in the world economy. Then all the money printed by the US Fed to finance the Vietnam War came come to roost. This was a contributing factor to the double digit inflation of the 1980s. In turn this pushed the Wage-Price Spiral into macroeconomic management debates. Older economists like me are concerned that the same thing MAY happen once Quantitative Easing (Expansion) moves into its final stage. The world stock markets are already watching the US Fed Reserve as its uses interest rate creep to wind back its balance sheet imbalances. Still I haven’t yet gone over the MMT site so these concerns may be of little concern in this century of monetary management theory.

Regarding 1970s inflation; excessive liquidity has been blamed for that, has it not? Comparison to the period post 2008 and the argument that QE would also lead to excessive inflation, has not been successful to date.

As I said here at the time (and I still stand by it) that billions if not trillions of dollars litterally vanished off the face of the earth in 2007-2008 in the form of housing collateral – values (ie money) that was made not from central banks or finance accounting, but predominately from private sector speculation & supply & demand forces. When such a large amount of money is removed from an ecomony, there will always be ample scope to reinject plenty of stimulus without risking runaway inflation. The challange is getting it to the broad economy without a significant chunk being chewed up by the likes of Wall st. That was certainly one of the early concerns with QE. Remember Japan’s Helicopter Money program – investment bankers were calling the Japanese economy “an insect searching for a windscreen” yet what happened – certainly no financial shocks.

Francis Bacon’s words criticizing medieval Scholasticism seem entirely appropriate to apply to modern economists as they debate. “For in the ordinary logic almost all the work is spent about the syllogism. Of induction (forming hypotheses) the logicians seem hardly to have taken any serious thought, but they pass it by with slight notice, and hasten on to the formulae of disputation… The syllogism consists of propositions; propositions of words; and words are the tokens and signs of notions. Now, if the very notions of the mind (which are as the soul of words and the basis of the whole structure) be improperly and overhastily abstracted from facts, (being) vague, not sufficiently definite, faulty in short in many ways, (then) the whole edifice tumbles.”

I must admit I am now inclining to the blanket proposition that “Economics is a mess.” I make no exclusions. I mean all of economics from the classical to the neoclassical, from the most orthodox to the most heterodox. One can imagine, with a little poetic license, that one night in the late middle ages, some philosopher-alchemist threw up his hands and said “Alchemy is a mess.” He then decided to entirely renovate his profession and changed it beyond recognition. He left behind alchemy and created science. In reality, he wrote a philosophical text laying out the rudiments of an empirical ontology and the experimental method for science.

There is no one figure who fits the bill as our “philosopher-alchemist”. He is more a composite figure. Francis Bacon, 1st Viscount St Alban, 1561 – 1626, (quoted above) comes closer than many but he is a renaissance figure. The ideas of data from the senses, observations with instruments and experiments to test hypotheses came from earlier thinkers and contemporaries in a process of long development. We can note the work of the earlier Bacon, Roger Bacon c. 1219/20 – c. 1292 and his dependence on Alhazen (Hasan Ibn al-Haytham) for the latter’s work on optics. Alhazan “was also an early proponent of the concept that a hypothesis must be proved by experiments based on confirmable procedures or mathematical evidence – hence understanding the scientific method five centuries before Renaissance scientists.”

Economics today stands at about the same point as alchemy did in medieval times. People are playing around with real substances (chemicals then, economic “objects” now including “economic man”) with no idea of a fundamental ontology which would validly connect them in a consistent explanatory manner. Whatever works, works by accident and historical accretion (one might even say by emergence or evolutionary processes). It is trial and error without an underpinning ontology, without useful procedures for developing hypotheses and with no methods to test hypotheses in the field (ie. in the extant political economy).

I guess the question is this. Is economics too hard for humans to solve? I don’t even have to pull TOE out of the hat as an example of unsolved problems. There are existing examples even in classical physics.The three body problem is apparently basic yet, “Unlike two-body problems, no closed-form solution exists for all sets of initial conditions, and numerical methods are generally required.” – Wikipedia. I hope the physicists and mathematicians who blog here will back me up in saying large n-body problems are not solvable mathematically, at least not in any time span which would be useful to humans.

Economics is an n-body problem where n is in the zone of many, many billions if we add up all the individual ontological objects (not just classes) of even standard economics. Then on top of that the array dimensions of the problem are probably almost infinite.

Are we all being fools if we think economics is solvable or that economic arguments are solvable?

Rog: “Regarding 1970s inflation; excessive liquidity has been blamed for that, has it not? ”

If I remember correctly, Prof Quiggin wrote in Zombie Economics that union wage demands and therefore cost-push inflation, was a significant part of the problem 1970s stagflation. Mind you, I read that book when it first came out and that was a few years back so I may be wrong.

I admit to being a dunce when it comes to economics. I don’t understand why governments have budget deficits. If there is a shortfall in tax and inflation is low and unemployment high, why can’t governments just create money instead of creating a deficit?

I can see why tax is needed, to reduce inequality and to redirect demand from (often ephemeral) private expenditure to things like public infrastructure but I really don’t get why a government would need to run a deficit if the tax take is insufficient.

MMT rejects liquidity trap in a floating exchange rate system. MMT-ers never advocated for QE, not for stimulating reasons, not for inflation to pick up. MMT-ers argue that QE has deflationary bias because of private sector interest income that is lost to the CB now. MMT-ers are fiscalist, they don’t outright reject monetary policy influencing anything at all but they say that conventional monetary policy has mixed results at best. To them It is not a very. good tool to manage demand. They claim that they don’t want to change the current system to be treasury based but It already is treasury based system. They don’t use the term printing money when they want to be precise, they say there is no monetary operation that can be called that and It is a gold standard term. To them government deficit spending crediting bank accounts without issuing treasuries is no more inflationary than deficit spending with issuing treasuries and doing a reserve drain. Functionally to them issuing government securities is necessary if Fed wants to keep target Fed funds rate, otherwise the rate would fall to zero. Also Fed could be paying interest on excess reserves to maintain the rate. Monetary system to MMT is public monopoly. They pay attention more to private sector net financial assets that government deficits increase than mainstream monetary aggregates.

Thanks for posting.

“A crucial question is: what is the scope for seigniorage? In particular (expressing things in MMT terms), is the scope for seigniorage sufficient to permit the introduction of ambitious programs like a Green New Deal without the need for higher taxes to prevent inflation.”

That in MMT terms depends on domestic private sector and foreign sector desire to net save in dollar denominated financial assets.

Kristjan, How is seigniorage defined? Which dollar are you talking about?

As I understand your statements, “Monetary system to MMT is public monopoly” and the scope of seigniorage “…in MMT terms depends on domestic private sector and foreign sector desire to net save in dollar denominated financial assets” implies “the public” consists of about 7.5 billion people, some of these are called ‘domestic’ and others ‘foreign’ but all of them can only save in a new currency called dollar. My question is: Who issues these dollars? Is a new global institution required?

What do you mean when you write, “MMT rejects liquidity trap in a floating exchange rate system” ? The term liquidity trap refers to a set of specific conditions in specific theoretical models. These conditions define the term ‘liquidity trap’. How does “MMT” define “liquidity trap”? And why does “MMT” talk about a flexible exchange rate system, given that there is apparently only one currency, “dollar”.

You write: “MMT-ers never advocated for QE, not for stimulating reasons, not for inflation to pick up.” I am very confident is saying that those who implemented QE also did not do it for ‘stimulating reasons’ (assuming the term has the same meaning as in mainstream macroeconomics) or for inflation to increase, but for reasons given in my earlier post and by Troy Prideaux on this thread. Both, Troy and I wrote about it when the topic of GFC and QE were first discussed on this thread many years ago.

You write: “MMT-ers argue that QE has deflationary bias because of private sector interest income that is lost to the CB now.” I assume CB stands for central bank (even though this global organisation, which MMT seems to require doesn’t exist as yet). If you had written something to the effect that MMT-ers had argued to let the global financial system that is connected to the proverbial Wall Street bankers, including the payment system instead of buying up junk bonds (in exchange for US dollars in the US and in exchange for Euros in the EUROzone in addition to treasuries, then I would at least get the idea that MMT-ers are revolutionaries or extreme libertarians who prefer barter to any form of financial securities. But as it stands, … well it is probably pretty obvious what I have in mind.

“You write: “MMT-ers argue that QE has deflationary bias because of private sector interest income that is lost to the CB now.” I assume CB stands for central bank (even though this global organisation, which MMT seems to require doesn’t exist as yet). If you had written something to the effect that MMT-ers had argued to let the global financial system that is connected to the proverbial Wall Street bankers, including the payment system instead of buying up junk bonds (in exchange for US dollars in the US and in exchange for Euros in the EUROzone in addition to treasuries, then I would at least get the idea that MMT-ers are revolutionaries or extreme libertarians who prefer barter to any form of financial securities. But as it stands, … well it is probably pretty obvious what I have in mind.”

Currencies don’t leave currency zones. US Central Bank bought assets in dollar zone. The dollars remained in reserve accounts at FED as reserve balances, they cannot leave. You can pack cash in USD in your bag and go to Australia and say that currency left the currency zone but those dollars are still Fed liabilities and Central Bank in Australia has nothing to do with them. You can’t pay taxes in Australia in USD and so on. So if your assumption was that Fed was doing QE globally then that is not correct. Euro exchange and all that, holders of the USD change but dollars remain in reserve accounts at the Fed.

“As I understand your statements, “Monetary system to MMT is public monopoly” and the scope of seigniorage “…in MMT terms depends on domestic private sector and foreign sector desire to net save in dollar denominated financial assets” implies “the public” consists of about 7.5 billion people, some of these are called ‘domestic’ and others ‘foreign’ but all of them can only save in a new currency called dollar. My question is: Who issues these dollars? Is a new global institution required?”

Foreign holders of USD dollars is foreign sector, foreign governments and private sector agents. Those dollars are not spent (their desire to net save in dollar denominated assets), they are saved, and domestic private sector. I was talking in regard of inflation that how big should deficit be, It is hard to know, deficits can cause inflation. Can the whole Green New Deal be funded without additional taxes with stable prices? I don’t know, I am talking theory, I haven’t studied the actual numbers. Fed issues reserve balances that we call US dollars.

“What do you mean when you write, “MMT rejects liquidity trap in a floating exchange rate system” ? The term liquidity trap refers to a set of specific conditions in specific theoretical models. These conditions define the term ‘liquidity trap’. How does “MMT” define “liquidity trap”? And why does “MMT” talk about a flexible exchange rate system, given that there is apparently only one currency, “dollar”.”

There are plenty of currencies in the world today, There are plenty of fixed exchange rate regimes. Liquidity trap is associated with IS-LM, MMT doesn’t use that framework. Mainstream Keynesians try to reverse engineer MMT position in that model and It is not really describing floating forex system.

There is liquidity trap for you.

https://www.investopedia.com/terms/l/liquiditytrap.asp

For MMT it is not about the liquidity since floating forex system is not liquidity constrained, so It requires fiscal adjustment.

IS-LM is loanable funds model, MMT claims that money supply is endogenous and system doesn’t operate according to that model. There is no fixed amount of loanable funds, Krugman is a believer in loanable funds, deficits crowd out private investment etc. MMT rejects that, deficits don’t crowd out private investment.

Best

“IMO, QE had nothing to do with mainstream Keynesian (or MMT whatever it is) monetary policy. Its aim was to prevent the collapse of the financial system, including the payment system.”

That was not the aim. All those assets that Central Banks bought are accounted for, their interest payments still paid and so on. Central Banks don’t do bailouts, governments do that. All Central Bank monetary operations are neutral in this regard, they don’t add net financial assets to the private sector, they do assets swaps. There are few exceptions, Central Bank buying gold gor example. Government deficit spending adds net financial assets to private sector.

A bid for some experimental economics. My objection to monetary economics of either flavour is that it does not really take seriously Keynes’ distinction between the transactions and investment demands for money. The strong hypothesis is that these now flow in separate circuits. Central banks create monetary base – in the investment circuit, where financial intermediaries just sell bits of paper to each other. The money goes round and round, but never reaches the real economy. The two moneys have the same legal characteristics, but are functionally distinct.

This could be tested by attaching electronic tags to units of newly-created monetary base, heritable by its offspring in monetary expansion. You then observe where the money goes. If none of it shows up in wages and supermarkets, the hypothesis is confirmed. Technically a bit complex, and the experiment violates anonymity, but would supply some actual evidence.

Hugo,

I was thinking more of the inflationary consequences of the Vietnam war.

The reserve balances (monetary base) cannot reach real economy. They cannot be lent out by banks to the real economy, they are used for payment settlement in between commercial banks themselves and Fed (treasury account is at Fed too). That is one reason QE is flawed. The reason banks are not lending to the real economy is not that banks don’t have enough reserves to lend, they are not reserve constrained. Their lending activity is never constrained by quantity of reserves. They might be very sensitive about the price of the reserves. Supermarkets and wage earners don’t have accounts at Fed, that is the only place those reserve balances can exist.

Arguing without history and ontology is always a fruitless business.

The central idea of Modern Monetary Theory (MMT) is that money is a notional not a real quantity. This has been an idea emerging, in practice first and later in theory, since the first days of commodity money. The first step which developed commodity money, be it gold, silver or shells, was the first step towards abstracting, generalising and thus notionalising money. People making wampum belts were “printing money”, not just making gifts. This was true at least in the latter stages of the use of wampum in the mid-seventeenth century, when Dutch colonists in the New World “discovered the importance of wampum as a means of exchange between tribes, and they began mass-producing it in workshops.” [1]

Thus, the idea that money is or can be notional is certainly not an MMT invention. It is hundreds of years old at least. As is usual in most matters, people discover and develop a possibility in praxis and only later do the theorists came along to “discover” the idea. Practical and experimenting persons are the “philosophers for the philosophers”. Little to nothing was ever discovered by pure reason alone. (This statement might not hold for mathematics.) But certainly, once an idea occurs to a mind from the impetus of its practical and material genesis, the mind can elaborate systems of ideas (formal systems) and then use formal system calculations (heuristic or algorithmic) to manipulate real quantities. The manipulations are successful, wholly or in part, if the formal system bears some truth correspondence or “isomorphism” (from Bertrand Russell) in relation to the real system.

Money became entirely legally notional in the process commencing with abandonment of the gold standard in 1931 by Britain and in 1933 the partial abandonment of it by the USA. The process of fully “notionalising” money was more or less completed in 1971 when the USA abandoned the remnants of the system in 1971. The gold standard was completely replaced by fiat money.

Thus, there is nothing new in MMT theory in this regard (that money is now fully notional). The best that MMT can argue is that the public and various economic theorists have not fully understood the possibilities inherent in the absolute fiat money system. Certainly, the public have not fully understood the possibilities. Indeed, one can argue that they have been deliberately kept ignorant. Theorists vary. Some have understood. Some have not understood.

Wikipedia notes that: “The post-Keynesian economist Thomas Palley argues that MMT is largely a restatement of elementary Keynesian economics, but prone to “over-simplistic analysis” and understating the risks of its policy implications. Palley denies the MMT claim that standard Keynesian analysis doesn’t fully capture the accounting identities and financial restraints on a government that can issue its own money.”

My opinion now is that Palley is considerably justified, if not completely correct, in making these criticisms. MMT is not as innovative nor as ground-breaking as its proponents claim. However, it empirically and accurately studies and maps (for want of a better word) the creations ex nihilo and then the flows of notional or fiat money in the modern system. The facts of how these creations and flows work are important and need to be made public knowledge. Capitalists have a vested interest in obscuring a great many things and processes in order to protect and further their exploitation systems. One of these is how money is made and circulated. The public is kept ignorant of how fiat money is really made and circulated and hence it is kept ignorant of the possibilities inherent in the system. The fruitless bickering of economists of the various schools, without proper attention to history and ontology, is only clouding the issue further.

I cannot believe that the “economists of the various schools”, as I call them, cannot figure this out and come to a common agreement on certain matters. Perhaps too much ego, reputation and remuneration are at stake. Either that or an ignorance of history and ontology. Let me outline what I mean. When it comes to the creation and circulation of fiat money, this is a formal system with tokens (units of account) stored and circulated in real systems. The real system(s) now are networked computer systems. Thus the data on the government side and data on the private side (banks) which are part of the entire networked system are on the system. Let me reiterate. The (admittedly dynamic) data are on the networked system. In theory, they can be studied within a bit of their life, albeit it’s not easy to do a real-time study, but that is scarcely necessary anyway.

Just as hydrological engineers, over time, design a complex storages and pipe system (say the water system for a major city) and workers build it, so do the state’s financial economists design the financial “piping” system and have it implemented by workers. Both systems are fully amenable to flowcharting since they are each the epitome of dynamic flow systems. In the case of both systems, long historical accretion may mean the system is (partially) incompletely and incorrectly mapped in formal records (plans and specifications of the entire) system.

A human created system can work, be operated and be maintained, in the main, for most purposes, when no one human or no one plan holds all the essential information in a single consolidated repository. It may not always work best under these conditions of “globally imperfect knowledge” but overlapping partial knowledges. The answer in that case is a comprehensive field study for want of a better term. Now, I am not saying this study is certainly necessary. It might be necessary. Or the information might already be available in one plan in one repository or in several places (it very probably is). The real need is to make this information publicly available and publicly understood.

What this would mean would be making all the formal information (as a master-plan of main flows and all relevant categories but not of extensive detail) that is NON-CONTROVERSIAL (ie. economists of the main schools agree as to its accuracy) publicly available.

The formal fiat system (creations ex nihilo, stocks, flows and destructions ab nihilo) should be mappable and mapped and non-controversial. This is the part on which all economists and educated laypersons should be able to agree. Great problems of course will thence arise with respect to interpretations (especially but not only ontolgical definitions) and what this system “means”; what it imputes, what it induces both with respect to human agent psychology, social psychology and especially what it causes or generates with respect to real economy behaviour. This is where controversies can and should arise.

As I wrote at the start, “The central idea of Modern Monetary Theory (MMT) is that money is a notional not a real quantity”. This idea is not unique to MMT. The primary thesis of MMT is that money is not neutral. This is implicit in asking what the fiat system money “means” and giving examples above. What it means or might mean consequentially is the issue. This thesis, that money is not neutral, also is not unique to MMT. I am pretty sure that the several brands of Keynesianism share it. Implicit in this thesis is the idea that fiat money management should used in such a way as to benefit the general public or to benefit private (usually sectional) interests. Neoliberalism and monetarism make the second judgement and take the second path. It is almost axiomatic that sectional interests want incomplete knowledge to be the order of the day. They want to keep those outside their interest ignorant. On the other hand public interests demand the widest dissemination of knowledge to make it public knowledge.

People (mostly laypersons) get lost arguing about what the actual circuits of fiat money are. They are quite complex in the extensive sense and there are some seeming paradoxes in debt and credit. Economists of the various schools get lost, in the main, in arguing what fiat money means consequentially. This comes down, in some senses, to whether one regards money as neutral or not. So, I wish for a start the economists would state up front whether or not they accept the neutrality of money theory and/or in what senses or situations they accept it or not, for example in relation to short time lapses and long time lapses.

Let me state at this point and as a conclusion. I certainly do not regard fiat money as neutral. Neither do I regard it as omnipotent which at least bowdlerized MMT does. Of course, there is much more to debate but this post is already more than long enough.

Here is the short version of my long screed above.

1. Fiat money is a notional not a real quantity.

2. Fiat money is not neutral.

3. Neither is fiat money omnipotent.

4. As fiat money is not neutral how it is managed matters.

5. Neoliberals and monetarists manage fiat money for the benefit of private sectional interests.

6. MMT propounds that fiat money be better managed for general public benefit.

Theoretical and practical considerations which follow from these propositions are;

1. To say that something is notional (formal) is not to say that it cannot interact with the real. It is easy to demonstrate that human generated notional or formal systems interact with real systems and vice versa via human agents. If a carpenter has a house plan on paper, she has a notional or formal system drawn on that paper. It is a static system but a system nonetheless of lines, notations and annotations. When viewed It interacts with dynamic systems in her brain, including extensive knowledge systems there which permit her to read and decode the plan, to interpret it and transform it in her mind and thence take physical actions to render the various formal measurements, lines, shapes etc.real in real materials.

2. Point 1. is really a slam-dunk case which proves this point. The fiat money system (like any money system) is not neutral. It is used by computer and human agents to manage real systems. The money tokens are not neutral either. They are exchanged for real goods, services and labour by the actions of human agents.

3. Some bowdlerized versions of MMT seem to imply that fiat money is nearly omnipotent. If we re-manage it, then we can re-manage everything and solve just about every extant economic problem. Genuine MMT theorists do not say this and always caution that real constraints are real. Genuine MMT theorists do point out validly that managing a formal system well for broad pubic benefit can be very important to real outcomes for the public. They are not the only economists to say this of course. Some MMT boosters considerably overstate their case and use a number of strained analogies, histrionic rhetorical devices and inflated claims to dazzling originality which polarize outsiders and evoke either blind devotion or outright derision. This is unfortunate because there is much of substance in MMT positions.

4. This point follows logically from point 2.

5. This is an assertion I make from a socialist and democratic viewpoint. I think it can be logically and extensively backed up with empirical evidence but that’s another post.

6. I agree with this proposition and it follows really from all the points above.

Next post, after some replies by others, I will put my views on the seigniorage issue.

Erenstine you ask such good fundamental questions. I love system dynamics. I searched;

“system dynamics” stock flow diagrams “modern monetary theory”

We treat externalities when exposed like this ” It proposes putting an ambulance at the bottom of the cliff whenever there’s a crash, instead of preventing them happening.”

Love that quote! See below.

Maybe some mmt model for you in these?

***

DIAGRAMS & DOLLARS

A 5 star (58%) commenter obviously more qualified than I said ” ‘Since that time, I’ve used system dynamic concepts to develop Monte Carlo simulations for a missile (Maverick), economic development of petroleum production fields, and an analysis of a proposed research process. It is a useful tool for better understanding many complex processes.

My only complaint about the book is that the author ignores fractional reserve banking, which seems to indicate that dollars are, in fact, created in the private sector, but his analysis is still correct because the federal government must supply the reserves making those new dollars possible. richard”

And a bonus click through with diagrams animation to sell kindle version <$2. Good value? Better exposé than most reviews.

http://jdalt.com/about/

***

“Summary

Macroeconomic theory was invented in the 1930s to develop policies to prevent a stock market bubble and Great Depression. It’s failed to predict or explain the 1990s stock market bubble or almost anything in the 2000s decade. This article proposes combining System Dynamics, invented at MIT in the 1960s, with macroeconomics to form a new Dynamic Macroeconomics theory that will predict and explain such things as recessions, inflation, and bubbles.”

John J. Xenakis

http://www.generationaldynamics.com/pg/ww2010.i.macro061025.htm

***

"How the Fed Could Fix the Economy… and Why It Hasn't" by Ellen Brown

"Quantitative easing (QE) is supposed to stimulate the economy by adding money to the money supply, increasing demand. But so far, it hasn't been working. Why not? Because as practiced for the last two decades, QE does not actually increase the circulating money supply. It merely cleans up the toxic balance sheets of banks. A real "helicopter drop" that puts money into the pockets of consumers and businesses has not yet been tried. Why not? Another good question… "

http://theeconomicrealms.blogspot.com/2013/02/how-fed-could-fix-economy-and-why-it.html

***

Me too^. And "Start with the standard textbook ISLM model.." of which I am not familiar.

"Reverse-engineering the MMT model

"I'm trying to keep this as simple as possible, so it's accessible to second-year economics undergraduates.

"Many theoretical papers I read are full of impenetrable (to me)^ thickets of math. So I reverse-engineer the model. I try to figure out what the underlying model must be in order for the paper's conclusions to make sense.

"Many Modern Monetary Theory posts I read are full of impenetrable (to me) thickets of words. So I have reverse-engineered the model (with the help of Steve Randy Waldman's blog post and Scott Fullwiler in comments on that post). I think I have figured out what the underlying model must be in order for MMT's conclusions to make sense.

"I don't think my model is a straw man. It is a stick-figure. A very simple caricature that shows only the bare bones, but is still recognisable.

Start with the standard textbook ISLM model…"

https://worthwhile.typepad.com/worthwhile_canadian_initi/2011/04/reverse-engineering-the-mmt-model.html

***

Poor formating below due to goo gl behaving badly

"On stock-flow consistent approaches and the like – Munich Personal …

https://mpra.ub.uni-muenchen.de by D Cavalieri · 2015

· modelling, 'modern monetary theory' (MMT) and the like … As SFCA modelling, system dynamics implies a multi-stage approach. … stock-and-flow diagrams containing three types of …"

***

"We Hold These Truths: The Hope of Monetary Reform by Richard C. Cook

Subject(s)Monetary

Genre(s)Economic democracy

Pages280 pp

ISBN978-0-9802190-1-2

We Hold These Truths: The Hope of Monetary Reform is a book (2009) by former U.S. federal government analyst and author Richard C. Cook, proposing a comprehensive series of measures to transform the dominance of a debt-based monetary system into one aligned more closely with the physical economy's productive values. The basis for the author's resolution is grounded in the work of C. H. Douglas and the reformer's advancement of Social Credit as a dimension of economic democracy.

http://theeconomicrealms.blogspot.com/2013/03/we-hold-these-truths-hope-of-monetary.html

***

To what extent can Positive Money and Modern Monetary Theory join forces?

A recent blog by Clint Ballinger highlights some of the similarities and differences between Positive Money’s proposals and those of Modern Monetary Theory (MMT) and other Post-Keynesian types of analysis. We thought Ballinger makes some good points that are worth highlighting, before suggesting where we think his review could be improved.

Ballinger starts his discussion by complimenting both sides,…"

Conclusions

…" Thus MMT fails to address the source of economic instability and the driver of the social and environmental degradation we see all around us. It proposes putting an ambulance at the bottom of the cliff whenever there’s a crash, instead of preventing them happening."…

Maybe this reference above is by a crank, yet is extensively referenced and noted.

http://theeconomicrealms.blogspot.com/2018/06/to-what-extent-can-positive-money-and.html

MMT WHACK-A-MOLE

Give me an MMT Model. OK!

1. There are only three ways to put the private sector in surplus

Run a government deficit & a current account surplus

Run a government deficit > current account deficit

Run a government surplus < current account surplus

2. https://t.co/M9Yg7c4h9x (The Sector Financial Balances Model of Aggregate Demand)

3. https://t.co/tgU9WGvfnV (The State as a Price Setter) – this one can probably be found elsewhere

There's at least TWO

Addendum to my post above.

Woops! I failed to make my case that money is not neutral. The perils of theorizing on the run! I only made the case that nominal quantities can affect real quantities through the actions of human agents. That’s a trivial observation, TBH.

“Neutrality of money is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption.” – Wikipedia.

Where the neutrality of money thesis falls down is that it presupposes an omnipresent, instantaneous and perfect market (perfect competition) right across the extensive real economy. Such a market simply does not exist. Money is not neutral due effects like velocity, time lags and hysteresis plus matters like nominal debt vs. debt deflation.

Short run monetary-disequilibrium theory does not save the neutrality of money thesis. From chaos theory, small changes in initial conditions can make a great difference to the system in the long run. This comes under the head of “sensitive dependence on initial conditions”.

Ikonoclast @ 7/3/19, 10: 39

You raise some important questions regarding economics, which, IMO, should be considered by all those who claim to have “the” answer about “the economy”. For what it is worth, IMHO, analytical math econ models can’t solve all problems in economics but they are very helpful in resolving conceptual fog in what is often peddled as theory. It is difficult to draw parallels between natural science and economics, as disciplines. However, environmental science, specifically climate science, does encounter at least one problem it shares with economics. Empirical tests are extremely limited because a full or complete test could or more likely would destroy the purpose of the fundamental research questions.

(As an aside or a private note, it is my pleasure to have been allowed to observe your sincere work to make sense of what is going on around you and all of us. This is what I call human progress on a micro-level – never a boring moment in the individual’s life.)

MMT rejects IS-LM and the concept of a liquidity trap.

MMT talks about flexible exchange rate as it recognises the trilemma

Currency regimes and policy space: conclusion.

Let usquickly review the connection between choice of exchange rate regime and thedegree of domestic policy independence accorded, from most to least:

*Floating rate, sovereign currency most policy space; government can “afford” anything for sale in its own currency. No default risk in its own currency. Inflation and currency depreciation are possible outcomes if government spends too much.

*Managed float, sovereign currency less policy space; government can “afford” anything for sale in its own currency, but must be wary of effects on its exchange rate since policy could generate pressure that would move the currency outside the desired exchange rate range.

*Pegged exchange rate, sovereign currency àleast policy space of these options; government can “afford” anything for sale in its own currency, but must maintain sufficient foreign currency reserves to maintain its peg. Depending on the circumstances, this can severely constrain domestic policy space. Loss of reserves can lead to an outright default on its commitment to convert at the fixed exchange rate.

http://neweconomicperspectives.org/2011/11/mmp-blog-26-sovereign-currency-and.html

QE from an MMT perspective is explained nicely by this YouTube Video

Understanding bonds and debt issuance you can see the currently and always remarkable Stephanie Kelton elucidate from an MMT perspective here: http://neweconomicperspectives.org/2010/11/yes-deficit-spending-adds-to-private.html

I’m incredibly sorry about the multiple posts but I had to scroll up and down to see what I am responding to. Hopefully I’ve answered most of Ernestine’s questions now and my previous comment should address John’s question

Ikonoclast question over descriptive or prescriptive does go to a central MMT insight specifically about the Job Guarantee

Is the Job Guarantee (JG) central to MMT? Yes!

It comes down to this:

With ‘state currency’

There necessarily is,

Always has been,

Always will be,

A buffer stock policy.

Call that the MMT insight if you wish.

So it comes down to ‘pick one’-

1. Gold

2. Foreign Exchange

3. Unemployment

4. Employed/JG/

5. Wheat

Whatever!

We pick employed/JG As it works best as a buffer stock based on any/all criteria for a buffer stock.

It is important to understand the primary function of a JG is to provide price stability and act as an automatic stabilizer as explained in the link.

http://neweconomicperspectives.org/2012/05/mmp-blog-50-mmt-without-the-jg-conclusion.html

I think that’s all the questions covered.

Other than the US specific platinum coin legal seigniorage option I’m not sure MMT deals in seigniorage. I agree with Ernestine about the effort for $1 vs $1 trillion today especially since most, if not all accounts are credited electronically with keystrokes these days. However I am happy to be corrected by an MMT academic 🙂

Ernestine & Sennex,

1. Ernestine,

Thank you for your encouraging comments. As one of those who used to think he had “the answers” for “the economy”, I have certainly benefited from your perspectives over the months and years. I no longer think I have all the answers, that’s for sure. However, I have more questions than ever.

2. Senexx,

No need for apologies for multiple posts. I will certainly try to work through and understand them.

3. All,

The approach I am taking now, as a personal project, is to develop a variant of monist metaphysics. Obviously, this is a modest autodidact project which involves no tilting at windmills at all. 😉

Nevertheless, the terrible Gordian knot that I and many others seem to tie ourselves into when contemplating economics in particular and the social sciences in general, seems to mandate a return to fundamentals. If one can’t propound what exists at the most basic and universal levels, how it exists and how existents interact, then one really cannot make any progress in developing a coherent theoretical system to deal with real systems and formal systems in the social sciences. I mean particularly a system which seeks to explains (or methodically doubts) connections, causations and laws and seeks to make sense of the complex emergent systems dealt with by the social sciences.

Of course, propounding a basic ontology unavoidably means advancing a founding a priori assumption about existence. From that point, three questions matter;

1. Does the founding a priori assumption have only doctrinal (dogmatic) justification or does it have some epistemic justification (via knowledge from experience).

2. Can the founding a priori assumption be used deductively to develop a full metaphysical system internally consistent in every particular?

3. Can the consistent metaphysical system then be shown to possess broad cross-consistency and contiguity of explanation with the known facts and knowledge areas of the hard sciences?

As Hofstadter out it: “The problem is to state a provisional conception of reality which is as far as possible continuous with the goal of traditional metaphysics and which nevertheless is of empirical import.” A corollary of this statement taken to a slightly harder stance is this. We need to redevelop metaphysics so it is, as far as possible, consistent and contiguous with hard science. Yet, this redevelopment must not exclude the ability to make intelligible and supportable statements in the fields of economics and the social sciences.

I hope people get what I am driving at here as a kind of mission statement for the project. As to method and philosophical-analytical process there is much to say about this too. I will try to put a bit more in the next sandpit but pitch it purely from the economic angle so as to provide an example of my theory and method. There is already a screed of 3 sections of just one draft chapter on the current Sandpit. It gives an idea of what I am up to.

I haven’t forgotten my promise to post here my ideas about seigniorage.

As Bob Dylan sang;

“Seignior, seignior,

Can you tell me where we’re headin’

Lincoln County Road or Armageddon?

I just can’t stand the suspense anymore.

I’m ready when you are, seignior.”

😉

I find MMT confusing. You can fund deficits without raising taxes or issuing debt just by printing money without creating inflation. Well to a limited degree you can if people are adding to their money balances (e.g. transaction balances) to accommodate economic growth.

Since 2008 the Fed’s purchases of Treasury bills from the banks have driven interest rates to historic lows and produced one of the biggest rallies in US equity markets in years. Private sector debt has surged but much of it has been spent on equities whose price increases have captured the inflationary impact. The fact that product prices and wages have not moved much does not mean that inflation has not occurred. MMT sounds like a snake oil recipe to me.

BTW in the 1960s and 1970s seigniorage normally referred to the impact of inflation of money balances. The “inflation tax” meant things were sold to the government for a depreciating asset yielding a real transfer to the government. But I remember Robert Mundell mentioned, in passing in one of his articles, that the actual issuing of money yielded seigniorage for the government. Ideas recycle!

My take on seigniorage. Let us first look at the Wikipedia definition.

“Seigniorage is the difference between the value of money and the cost to produce and distribute it.

The term can be applied in two ways:

1. Seigniorage derived from specie (metal coins) is a tax added to the total price of a coin (metal content and production costs) that a customer of the mint had to pay, and which was sent to the sovereign of the political region.

2. Seigniorage derived from notes is more indirect; it is the difference between interest earned on securities acquired in exchange for banknotes and the cost of producing and distributing the notes.”

Definition 2. would seem to be more applicable today, To rephrase it for electronic money:

3. Seigniorage derived from electronic is also more indirect. It is the difference between interest earned on securities acquired in exchange for electronic money and the cost of producing and distributing electronic money.”

It seems to me that this kind of seigniorage would not be a significant income to the crown or fed. It could in some years even be negative depending on interest rates, wages of government employees, running costs of government / fed electronic systems including maintenance and new (sometimes costly) implementations.

J.Q. seems to have a wider definition of seigniorage to mean all unfunded (true deficit) money printing. Is this what J.Q. is saying? In that case I say go for it.. to an extent. Print money (even electronically, in a true deficit, unfunded manner, but only do this as J.Q. says while maintaining stable inflation, achieving this by mobilising previously unemployed resources, hopefully.

I would go further and endorse the JG (Job Guarantee) to augment this strategy. See Senexx’s posts above. Surely, we could experiment with a JG by implementing it in Tasmania first. See how it works in Tassie as a real economic laboratory. To some extent transfer payments from the rest of Australia would simply be switched from welfare to JG. Maybe a residency requirement for the experiment would be two years continuous residency in Tasmania in the last 5 years to reduce effects of new migration from the mainland on the experiment.

Another important issue is that of the current oligopoly on debt money creation. The government has a monopoly on fiat money creation. However it licenses out debt money creation to an oligopoly of banks essentially. I would pull this right back and give the state not only a monopoly on fiat money creation but a monopoly on debt money creation. To Chinese wall it to some extent, the Reserve Bank for fiat money creation only at the orders of the Federal Govt. and a new National Commerce Bank for debt money creation. Commercial and Retail Banks would then seek to borrow from the National Commerce Bank before making commerical and retail (home and personal) loans. The new National Commerce Bank charges an interest rate and it ultimately controls and determines how much new debt money creation occurs. Just an idea of course. I think it could be used to better and more directly control total lending and take a proportion of Commercial and Retail Bank profits straight to the Commonwealth. Of course taxes on banks could be varied, maybe down, to cushion this if need be. But I think it would give government more direct levers on the economy.

Senexx said “I think that’s all the questions covered.”. Not so fast…

Sennexx, since you have deconstructed bilbo, easy Q’s for you… as Bill says “These assumptions serve to simplify the analysis and relaxing them does not alter the basic dynamics of the system.”.

So… What does mmt say to this person and where are they included please?

Q1. Does mmt assumes [asserts?] this person exists on their capital while markets restructure whole industries (and never has a gfc) and is at the mercy of “the costs associated with the flux of the economic activity as aggregate demand fluctuates.”? What might go wrong? Who picks up the wealth as it condenses again?

Assumptions;

– sucked all savings due to industry being disrupted 3x by innovative and monopoly and monopsonies productivity gains internal to shareholders and executives. And via “Economists call this response – wait unemployment.” As in “I’m waiting for my funds to run out, and then wait for employment and reduce my wage or go into debt to retrain [ 2 kids now 17 unemployed or becoming indebted, LVR on mortgage rising in sydney / melb and 50% of us are divorcing ] as I am not a property investor, major shareholder, bonus’d exec or rights holder. – does mmt conflate”

“Macroeconomic policy generally aims to reduce unintended unemployment.” Does this statement mean mmt conflates a states Policy with it’s own assumed mm theory?

“””Thus the whole buffer stock analogy is flawed.”””

https://ralphanomics.blogspot.com/2012/01/employer-of-last-resort-buffer-stocks.html

Q2. As ” A central bank also acts as a lender of last resort to the banking sector during times of financial crisis” does mmt advocate for the cental bank to also lend to non capital property right holders? Say first mortgage for anyone for principal place of residence or debts under a non growth economic model? Why / why not?

Q3. With mmt are all members of the state to which the central bank beholden and delivered via a democratic process also “the bank”?

Q4. Describe “full employment” via mmt and is any “one” person not included?

Q5. If price stability depends on market optimisation what happens when full employment is unachievable due to say a demographic shrinkage. Japan maybe or flight of workers from one state to another as in polish leaving UK vs Ukrainians being “price stabilizers”?

Q6. To get our logic correct we might try this: The JG pool expands (declines) when private sector activity declines (expands). The JG thus fulfills an absorption function, which minimises the costs associated with the flux of the economic activity as aggregate demand fluctuates.”

http://bilbo.economicoutlook.net/blog/?p=23887

What if the private sector was used to act as an absorbtion function for demands of society? Sort of reverse mmt or modern mammal theory?

Q7. Thought experiment 2. Or reverse again, what if the private sector offered “an unconditional, open-ended job offer at a given wage to anyone who desires to work” until they desired to leave the workforce. A good thought experiment for you to easily prove mmt. Reverse Bilbo with triple twist and dutch sandwich with no bread hiding contents; “When private [ read public ] economic activity picks up, workers [ read people ] would be bid out of the JG [ read private sector learning knowledge private sector controllers ] pool by employers [ read parteners ] and the buffer stock of jobs [ read buffer of pivate finances ] would contract.” Easy peasy to refute?

Q8. “”In fact wages and prices can rise much faster than is acceptable long before the so called buffer stock runs out. Which makes the so called buffer stock very different from conventional buffer stocks. That is, as long as government has a finite stock of some commodity in its buffer stock, it can sell that stock and ameliorating price increases. The same does not apply to the ELR or unemployed so called buffer stock.”…

“Thus the whole buffer stock analogy is flawed.”

https://ralphanomics.blogspot.com/2012/01/employer-of-last-resort-buffer-stocks.html

Considering above definition re buffer stocks “the so called buffer stock very different from conventional buffer stocks” does mmt consider meatspace analogous to rock piles or tanks of petrol or billets of steel?

Q’s 9,10 11 etc. War, gfc, bio or envrio disasters above trendlines and say black swans ala AGW?

Senexx thanks in anticipation, KT2.

“Another important issue is that of the current oligopoly on debt money creation. The government has a monopoly on fiat money creation. However it licenses out debt money creation to an oligopoly of banks essentially. I would pull this right back and give the state not only a monopoly on fiat money creation but a monopoly on debt money creation. ”

Fiat money created by government is debt money. If you want to end private credit creation and give that to the state in a form of nationalized commercial banking system then this doesn’t have anything to do with MMT in a sense that this your worldview and It can be done. But perhaps you are suggesting that you want to end private liabilities creation in a banking system, no home loans etc?

Senexx. Perhaps my quesrions were to vague. If you might just address this gut and Paul we may be able to get mmt.

So a guest Q. from Sumner and Krugman…

“Keynesianism, NeoFisherism, And MMT

By Scott Sumner of Econlib.org

Wednesday, February 27, 2019 12:47 AM EST

The title of this post lists three macro models that I believe are wrong. But they are not all wrong in the same way.

I’m not even sure I understand MMT, as when I try to engage with proponents of that theory they keep telling me that I’ve got it wrong. I say, “So you’re saying A, and here’s why that’s wrong.” They respond, “No, we aren’t saying A, we are saying B.” I respond, so you are saying B, here’s why that’s wrong.” And they respond, “No, we are not saying B, we are saying C.” Then I explain why C is wrong. It never ends.

Perhaps it’s just me. But here’s the problem for the MMTers. Paul Krugman is sympathetic to many of their policy preferences. He’s also “on the left”. He likes some politicians who like MMT. But he has exactly the same reaction to the model as I do:

Now, arguing with the MMTers generally feels like playing Calvinball, with the rules constantly changing: every time you think you’ve pinned them down on some proposition, they insist that you haven’t grasped their meaning.

I don’t expect everyone to be able to explain their models in a way that a slow mind like me can understand. But they should be able to explain it to one of the half dozen most brilliant economists in the world.

It seems to me that the problem with macro is that the underlying problems are so complex that there are a wide variety of ways to address these problems. For instance, just in the field of money, you have the interest rate approach, the quantity of money approach, and the price of money approach. Within each of those you have varying assumptions about price stickiness, Say’s Law, crowding out, rational expectations, Ricardian equivalence, market efficiency, and a host of other issues. The possible approaches quickly multiply, each developing different frameworks and even different languages.C + I + G = PY. MV = PY.IS/LM.AS/AD. Etc., etc. You end up with with a sort of Tower of Babel.”

I should have included http://www.levyinstitute.org/publications/can-taxes-and-bonds-finance-government-spending with an MMT take on Bonds which is really is just an Interest Rate Maintenance adjustment.

MMT would agree with Harry Clarke above.

For MMT in simplified form read Mosler’s 7 Deadly Innocent Frauds. As I put forward years ago I see 7 DIFs and Zombie Economics as complementary. As both debunk a lot of mainstream economic thinking.

For the foundational work of MMT read Mosler’s Soft Currency Economics

For most recent nutshell version of MMT which is just Macroeconomics done correctly read John Harvey in Forbes https://www.forbes.com/sites/johntharvey/2019/03/05/mmt-sense-or-nonsense/

KT2 I hope to come back and will address any questions I consider myself capable of doing but by all questions covered I meant the ones raised by John and others in the comments thus far. I also put a little bit in the sandpit because I know John considers MMT an Idee fixe. I consider MMT thus far as an accurate construction of currency regimes and their constraints.

Full employment under MMT is easily defined, everyone that wants a job has one. In more academic terms frictional unemployment. What we had post world war 2 until we regressed from some of Keynes views in the mid 70s.

I did write a few things but I was unhappy with my word choices. The FAQs and their supporting links I left the link to in the sandpit will help answer many of your questions.

MMT takes the description of how things operate, including the balance sheets (accounting) and then says now we know this, how can we use it better. From there you get MMT informed policy ideas.

KT2, just saw your second post. MMT doesn’t consider itself a model though there is modelling done within MMT. It is a matter of a paradigm shift and a change in thinking. Hopefully my my comment and links above shall help you out. The John Harvey one I specifically recommend for you. 🙂

James Wimberley says at March 8, 2019 at 6:56 am…..

James, That’s a really interesting assertion. Is it true? I wonder if any MMT expert could tell us? If it is true, and we have two financial circuits hermetically sealed from each other, then what does that mean, I wonder?

I can certainly think of cases where two hermetically sealed circuits can influence each other without flowing into each other (using hydraulic or electrical analogies). But there then has to be some other mechanism to transfer effects. This could mean that “electrons” or tags from one not turning up in the other is not a proof that hermetically sealing the “fluids” necessarily seals the two systems from affecting each other.

But perhaps you were not asserting precisely that. If one circuit was about owning certain kinds of “fictitious capital”, meaning capitalisation on property ownership or tradeable paper claims to wealth and the other circuit was about paying for wages and trading commodities (essentially), then we have a special kind of two-circuit financial economy which could explain booming assets and very low inflation in wages and commodities.

This is just a mental speculation on my part.

My conclusion on MMT. Like other macro-economic models, MMT ‘theorists’ do not include the financial system in their models. By financial system, I mean non-government agents can issue a myriad of types of financial securities denominated in the official currency unit, in exchange for other financial securities, denominated in the same or other currency units, and these securities can be traded via a network of non-government agents almost anywhere in the global economy. There are many types of ‘debt’. There are many forms of payments, denominated in a currency unit (eg company X takes over company Y by means of issuing more of its shares in exchange for at least a controlling fraction of company Y shares, this is not necessarily without consequences for employees, suppliers, customers, and the tax office).

MMT does not have a clear concept of money and they seem to confuse ‘money’ with ‘value’ and, at times, with ‘wealth’. (Writing M for money does not specify a concept; it is only a letter in the alphabet. Having an amount of M means to me there is an unspecified number of the letter M that is greater or equal to 1). The distinction between ‘money’ and value is captured in JQ’s question, money for nothing? in an earlier post on the topic MMT.

Senexx MMT model no 1 is an example of an accountant rewriting (national) accounting equations. In relation to the topic of the thread, this model makes sense to me if the ‘the economy’ consists of 3 individuals. One is called P for private sector, one is called G for government sector and one is called F for ‘current account’. As soon as there are more than 3 individuals, the question is who gets any surplus. This model is ridiculously inadequate to address the question of how to finance the New Green deal! Prof Q can’t see how the New Green deal can be financed without increasing taxes and I can’t see it either. To start of with, the income and wealth inequality within the USA is a serious problem that cannot be solved by enlarging the Fed’s balance sheet (more zeros behind some integers that correspond to ‘printing of money” in the contemporary money technology). The time when the USA could ‘print’ more US$ to acquire real resources or waste them with war due to the absence of a competitor in the world of ‘money’ has all but gone. The Chinese are now more interested in buying up companies in the USA and in Europe and elsewhere instead of holding US denominated financial securities, if they are allowed (MMT theorists, please check your often mentioned notion of ‘sovereignty’) and the EURO is becoming a serious competitor to the US$ regarding international trade transactions. (Senexx, no offence if I don’t read the link for your item 2).

MMT theorists have ideas that are in direct contradiction with observables.

For example, I am told by Kristjan above that a) QE is not inflationary (but deflationary) and b) it has nothing to do with preventing the collapse of the (almost global) financial system and c) the monetary base does not influence the ‘real economy’. In short, what I say is wrong, false, rubbish …. Really?

JQ’s post includes a diagram showing the graph of the time series of the adjusted (however defined) US monetary base from 1986 to 2018. This diagram shows a sharp increase (spike) in the monetary base in 2008, another one in 2011/12 and again in 2013/14. According to my conceptual framework, these spikes correspond to QE1, QE2 and QE3. Prior to 2008 there are 2 little blips in an otherwise smooth growth in this monetary aggregate. In my conceptual framework, these little blips are a reflection of short term monetary management via open market operations during times when there was some disturbance (eg the dot com bubble). I cannot use this graph to prove my explanation is true. But I can say that this graph is consistent with what I say is the reason for QE. If I were to take note of MMT, which I don’t, I would have to introduce some other hypothesis for these spikes, something like the decision makers decided for no economic reason to have a bit of fun with the monetary base – the graph of the diagram is too boring – leaving open the question why wasn’t there inflation as a consequence of this ‘mad’ QE behaviour. To get closer to substantiating my argument, some additional information is required. I don’t have to search very much.

The beginning of the global financial crisis (as distinct from the built up to it), started with what is known with the Lehman event in 2008. It is a well recorded fact that at that time the debt markets froze (no borrowing or lending between banks and therefore no new lending to others). So the MMT story about there not being a liquidity constraint with flexible exchange rates is not consistent with empirical observations. The Fed, in consultation with the Federal Government (which in turn had discussions with the governments of other countries – I recall the Chinese government sent a public message to the effect that the US better sort out its mess) took steps to defrost the debt markets by buying up financial securities for which there was no market (ie nobody wanted them) in exchange for official currency money (“properly accounted for” as is evident from the above mentioned graph!). There was no new ‘money’ created. There was an exchange of financial securities, privately generated debt (a type of financial security) was exchanged for official currency units (which has an interest rate of zero because the value of say a $10 note at the time of redemption is $10).

Now, while it is the case that QE did not affect ‘the real economy’ in the USA in the sense that individuals observed a change on their balance sheets, QE did affect the so-called real economy because I would not have liked to live in an economy anywhere in the global economy which is connected to the above mentioned financial system if QE had not happened, irrespective of my opinion of the institutional environment that underpins the contemporary international financial system. This is so because I don’t like starvation, mass unemployment, untended agricultural fields and survival being dependant on barter skills.

The work of theoreticians is not the same as that of people having a strong opinion on what they would like.

Finally, JQ raises the question of taxation regarding the New Green Deal. It seems to me taxation is not only important regarding the financing but also the related problem of income and wealth inequality.

Ikonoclast:

“James Wimberley says at March 8, 2019 at 6:56 am…..

James, That’s a really interesting assertion. Is it true? I wonder if any MMT expert could tell us? If it is true, and we have two financial circuits hermetically sealed from each other, then what does that mean, I wonder?”

I don’t see the March 8, 2019 at 6:56 am comment but in case you talk about commercial bank deposits and reserve balances then they are not hermetically sealed.

Some examples, you make a payment to me for a car 10 000 dollars.. I have a bank account at a different bank than you do. You give instruction to your bank to make the transfer to my account. These deposit transfers in between banks involve corresponding reserve movement in between banks because banks don’t accept each others liabilities as payment settlement. My bank doesn’t accept a new liability in its books unless It gets corresponding asset with It (the corresponding asset is Fed liability, reserve balances). Same goes with government paying you for something, bank has to get a corresponding asset with It. Your deposit in a commercial bank is your asset and bank’s liability (debt to you, IOU, promise to pay government money to your your demand).

When Fed buys a government security from you during QE then after that you have a deposit in your bank account and bank’s reserves increase, (monetary base, reserve balances). It “releases nothing” from anywhere, you could have sold your government security any time before. It is not about quantity, It is about price. Quantity is related to FED’s actions indirectly through price.

Ernestine Gross:

“By financial system, I mean non-government agents can issue a myriad of types of financial securities denominated in the official currency unit, in exchange for other financial securities, denominated in the same or other currency units, and these securities can be traded via a network of non-government agents almost anywhere in the global economy.”

Even you can issue all kinds of liabilities and you can denominate them in whatever you like. The difference between you and a commercial bank is that commercial bank liabilities are easily converted to government liabilities(money, tax credits). In that sense they are private and public partnerships and MMT says that. Their activity should be regulated in such a way that It serves public purpose.

They are doing QE in whatever reasons but there cannot be a situation when there is no liquidity in the system without payment system collapsing. Banks have to have access to liquidity. That doesn’t restore trust in interbank market when Fed is buying government securities (and that is what QE is). Now they having backward understanding of the system doesn’t refute MMT, does It?

James Wimberley @ 8/3/2019 6:56

I shall follow up your reference to Keynes distinction between flows of ‘money’ because it may turn out to be helpful in finding an angle to returning to some work from over a decade ago. At present the book-keeping system, the so-called balance sheet model of money, is not suitable for retrieving information quickly if at all. If you are interested in an alternative concept, namely that of ‘monetary objects’ (which does away with the distinction between ‘money’ and the ‘real economy’ and allows the tracing of transactions by issuer, currency unit and other characteristics within one coherent equation), I could send you a paper written by Andreas Furche and myself. (Furche was my PhD student. His background is in IT.) I don’t think it would be appropriate to upload this paper on this web-site and in particular not under this topic.